On March 18th, 2022, Guangzhou Ximalin Shunchao Eye Hospital, a Hong Kong eye brand founded by Professor Lin Shunchao, one of the world’s top 100 ophthalmologists, officially opened. The presence of Xima Ophthalmology in Guangzhou is an in-depth practice of medical and health cooperation between Guangzhou and Hong Kong, which will drive more high-quality medical resources from Hong Kong and Macao into the mainland, and it also marks a key step for Xima Ophthalmology to help the development of medical integration in Greater Bay Area. On the afternoon of the same day, the "Greater Bay Area Myopia Forum of Asia-Pacific Myopia Society and the 6th International Conference on Ophthalmology Precision Medicine of Hong Kong Xima Ophthalmology Group" was held online. More than 6,000 ophthalmologists gathered in the cloud to talk about the new technology and development of ophthalmology.

Guangzhou’s first Hong Kong-funded eye hospital opened.

Guangzhou-Hong Kong Co-creation of Guangzhou-Hong Kong Medical Cooperation Demonstration Project

In 2019, Guangdong, Hong Kong and Macao jointly signed the "Guangdong-Hong Kong-Macao Greater Bay Area Consensus on Health Cooperation" to jointly build a high-quality and healthy Greater Bay Area and establish a high-quality and efficient health service system in line with international standards. As one of the 9+2 urban agglomerations of Guangdong, Hong Kong and Macao, Guangzhou is a bridge and link between Greater Bay Area and the Mainland, which will undoubtedly strengthen the mutual learning and mutual learning of medical institutions in Greater Bay Area.

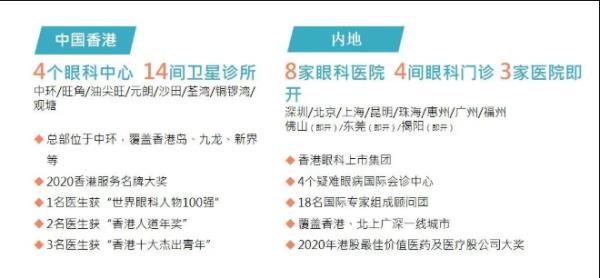

Professor Lin Shunchao, as a representative of the National People’s Congress in Hong Kong, has been fully supporting and responding to the national medical reform. In 2012, he founded Xima Ophthalmology Brand in Hong Kong, and in 2013, he founded the first wholly-owned Hong Kong-funded ophthalmic hospital in the Mainland under CEPA policy, bringing the medical model of Hong Kong to the Mainland and becoming a model of medical cooperation between the two places. In 2018, he successfully listed on the main board of Hong Kong. Up to now, Xima has set up 30 medical institutions under its banner, and has completed the layout in the first-tier cities in North, Guangzhou and

In order to further promote medical cooperation in Guangdong-Hong Kong-Macao Greater Bay Area and help the development of Healthy Bay Area, Xima Ophthalmology actively practices the development policy of Greater Bay Area, and strives to bring the medical technology and high-end precision medical management mode that Hong Kong is in line with international standards to Guangzhou, creating a new model for medical cooperation between Guangzhou and Hong Kong. Guangzhou Xima Eye Hospital is the first key hospital to be built on the occasion of the 10th anniversary of Xima Eye Group, and it is also the first cooperation project in Guangzhou-Hong Kong Health Care Ophthalmology. It is hoped to provide high-quality eye health services for the citizens in Guangzhou and surrounding areas by improving the fine management of ophthalmology sub-specialties and the deep integration of diagnosis and treatment technology and medical equipment.

Build an international medical and academic platform

Establish an international consultation center and an academic exchange base for difficult eye diseases.

In order to improve the international diagnosis and treatment level of ophthalmology, strengthen cooperation and exchange with international ophthalmology organizations, and build a platform for medical resources and academic exchange in Guangzhou and Hong Kong, on the opening day, Hong Kong Xima Ophthalmology Group and Asia-Pacific Myopia Science Association jointly hosted the Greater Bay Area Myopia Forum of Asia-Pacific Myopia Society and the 6th International Conference on Ophthalmology Precision Medicine of Hong Kong Xima Ophthalmology Group, and invited more than ten ophthalmologists from Asia-Pacific, Guangdong, Hong Kong and Macao to jointly set up the International Consultation Center for Difficult Eye Diseases and the Academic Exchange Base of Asia-Pacific Myopia Society.

It is understood that in 2018, Xima Ophthalmology and more than 200 ophthalmologists at home and abroad jointly launched the "International Consultant Alliance for Difficult Eye Diseases" and established consultation centers for difficult eye diseases in Shenzhen, Beijing, Shanghai and Kunming. The establishment of a consultation platform and academic exchange base for difficult eye diseases in Guangzhou is of great practical significance for deepening the reform of the medical and health system and effectively solving the health needs of the people. We will promote the rapid development of Guangzhou’s medical and health undertakings through cooperation in the fields of personnel training, expert consultation, academic lectures, difficult case consultation and surgical guidance, and medical resources.

Professor Lin Shunchao said that he has a long history with Guangzhou. He once worked in Guangzhou Zhongshan Eye Center for three years and got help from many experts and scholars. I hope to maintain good cooperation and communication with Zhongshan Eye Center in the future, and jointly promote the integrated development of medical care in Guangdong-Hong Kong-Macao Greater Bay Area.

multidigitauthorityExperts gather togetherAcademic grand meeting

Build Greater Bay Area.accurateMedical academic exchange model platform

On the afternoon of the same day, Greater Bay Area Myopia Forum of Asia-Pacific Myopia Society and the 6th International Conference on Ophthalmology Precision Medicine of Hong Kong Xima Eye Group were held simultaneously, which was jointly organized by Asia-Pacific Myopia Society, Guangdong Eye Health Association, Hong Kong Xima Eye Group and Guangzhou Xima Eye Hospital.

Professor Lin Shunchao, Secretary-General of Asia-Pacific Myopia Society, and Professor Ge Jian, Director of Ophthalmology Committee of China Association of Non-public Medical Institutions, were invited as the presidents of the conference. At the same time, there are also many authoritative experts from the eye center of Sun Yat-sen Eye University, the eye center of Beijing Tongren Hospital, the Eye, Otolaryngology Hospital affiliated to Fudan University, Shantou International Eye Center, Jinghu Hospital of Macau, Hima Eye Group of Hong Kong and other eye medical institutions.

Experts and scholars attending the meeting gave academic speeches and exchanges around three major themes: cataract and refractive surgery, glaucoma and fundus surgery, and myopia prevention and treatment, and shared clinical experience, new technologies and new achievements in ophthalmology, so as to promote the development of health care in Guangdong-Hong Kong-Macao Greater Bay Area to a higher quality and build a model platform for academic exchange of precision medicine in Greater Bay Area.

Introduction of Guangzhou Xima Ophthalmology

Hong Kong Xima Ophthalmology Group was founded by Professor Lin Shunchao in Hong Kong in 2012. It is the first listed medical group of Hong Kong-owned eye hospital established in the Mainland according to CEPA policy. With the support of government leaders and departments at all levels for many years, Xima Ophthalmology Group has been growing and developing. Now it has 30 ophthalmic medical institutions in Hong Kong, China and the mainland, and it is regarded as a pioneering model for cooperation between the mainland and Hong Kong in the medical field.

Lin Shunchao, the founder, is an internationally renowned professor of ophthalmology, regarded as one of the major leaders in the Asia-Pacific ophthalmology field, the first Chinese president of the Asia-Pacific Ophthalmology Society, and has been selected as one of the 100 most influential people in the world ophthalmology field for four consecutive years (ranked 18th in 2018). At the same time, Professor Lin has been elected as a deputy to the National People’s Congress of the Hong Kong Special Administrative Region for three consecutive years, and is also a member of the seventh Legislative Council of Hong Kong. He hopes that by responding to the national medical reform, he can introduce high-quality medical services from Hong Kong to radiate to the mainland and build a platform for medical cooperation between the two places.

Guangzhou is the medical center of Greater Bay Area and the key development city of Xima Ophthalmology Group. On the occasion of the 10th anniversary of the Group, the establishment of Guangzhou Ximalin Shunchao Ophthalmology Hospital is also the first cooperation project in Guangzhou-Hong Kong health care ophthalmology. The hospital is located on the central axis of the new city (300778) in Tianhe District, with an area of about 5,400 square meters. It has 50 beds and 4 international standard 100-level laminar flow purification operating rooms, providing international comprehensive ophthalmology services for patients.

The hospital’s medical team is powerful, led by Professor Lin Shunchao, from Hong Kong, China, the Mainland and the world respectively, and has an international advisory team composed of 18 international ophthalmologists from 10 countries, focusing on the diagnosis and treatment of difficult eye diseases such as vitreous body and retina, glaucoma and macular degeneration, refractive correction, prevention and control of myopia in adolescents, and cataract, and has rich experience in clinical diagnosis and treatment of other eye diseases. In addition, the special needs clinic of the hospital has rich experience in the technical treatment of congenital cataract, albinism and ocular genetic diseases in children.